In the past 24 hours:

The market is 0%

Fast and simple trading for all

Over 1300 trading pairs

We offer +50 currencies and over 1300 trading pairs so that you can balance your portfolio with ease.

4.6 stars reviews

Don’t just take our word for it. Check out what our users are saying about our iOS and Android apps.

We are here for you

Get the help you're looking for with in-app support and speak with a representative from our Customer Success team.

Regulated and proud of it

As the crypto industry continues to mature, we strive towards our goal of creating an open financial platform to bridge the gap between traditional finance and the decentralized world.

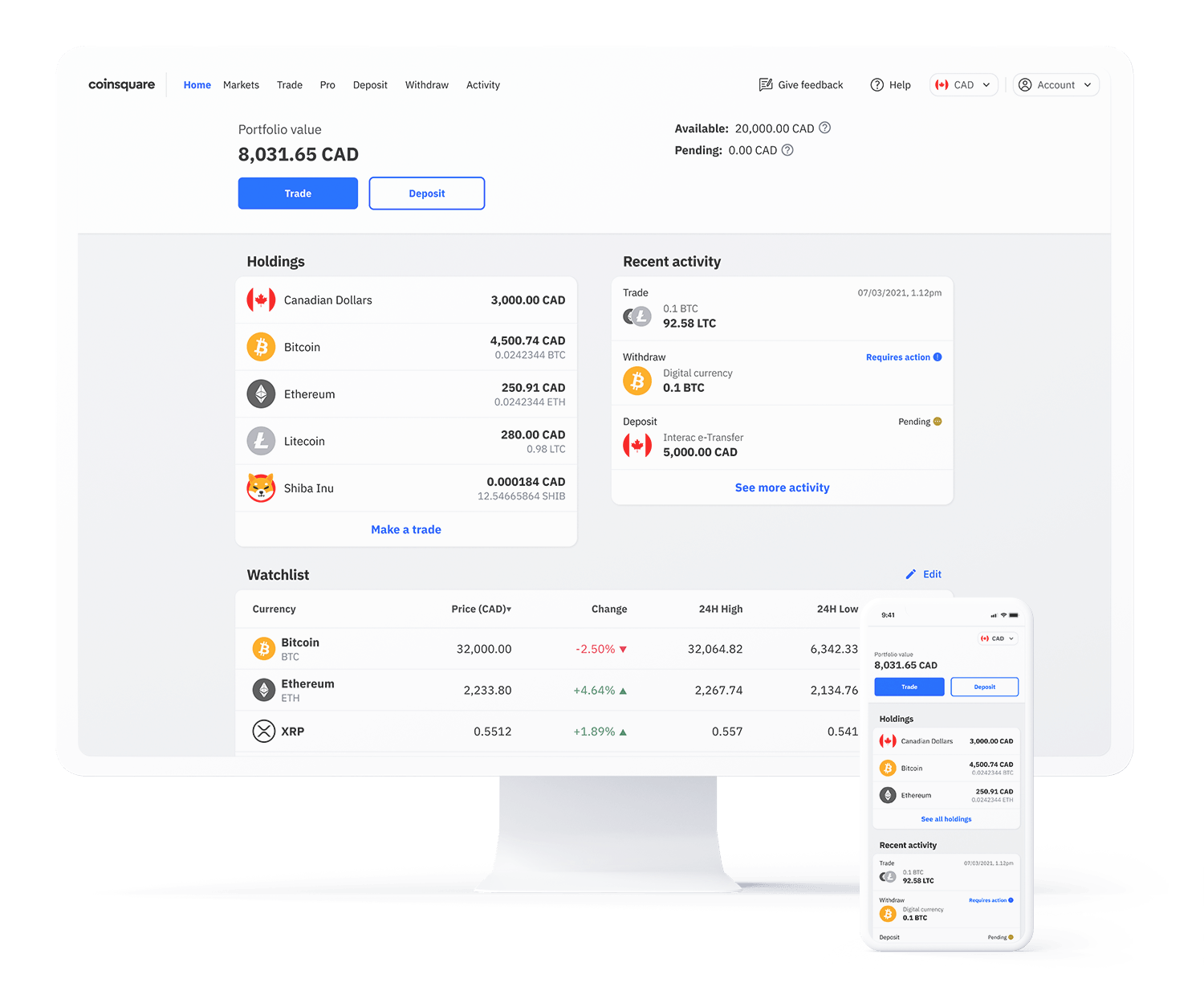

The right product for you

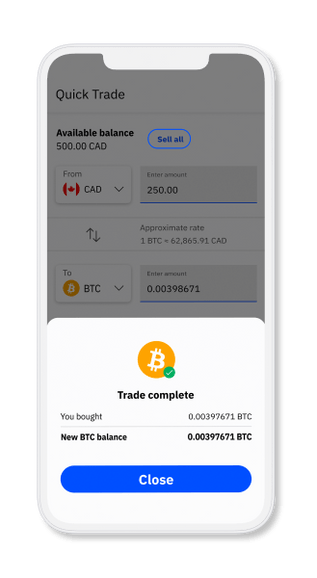

From beginner to Pro and everything in-between, we strive to empower all Canadians to build their crypto portfolio.

Making a quick trade has never been easier. Effortlessly buy, sell and HODL Bitcoin and other crypto using the simple and secure Coinsquare Trade app.

Enjoy personalized service from a dedicated CIRO-registered Investment Representative. Our Wealth Directors can help navigate all aspects of the crypto landscape including market structure insights and help with account management.

For active traders, it doesn't get better than this. Make advanced trades using Coinsquare Pro, view depth charts, interact with a live order book and set advanced fill instructions.

We take your security seriously.

At Coinsquare we take your trust and security seriously. Ensuring it's the cornerstone of everything we build.

We're regulated

Coinsquare is Canada's first crypto trading platform registered as an CIRO Investment dealer and marketplace member.

Your assets, held in trust

All client assets are held in trust with external, licensed custodians (Coinbase Custody, Bitgo Trust Company and Tetra Trust Company) who have a combined $680M USD in insurance.

We've got you covered!

As a Coinsquare client, the cash in your account is insured against insolvency by the Canadian Investment Protection Fund (CIPF). In the unlikely event that we become insolvent and the cash in your account is not available, CIPF will cover any shortfall of cash held in your account - up to $1 million CAD per account.

For Canadians, By Canadians

We’re on a mission to make buying, selling and holding crypto easier, faster and safer for Canadians, becoming Canada's first crypto trading platform registered as an IIROC Investment dealer and marketplace member. Our team of over 100 are paving the way for Canadians to start their crypto journey with the confidence that their investments are stored securely.

Founded

2014

Funding raised

$100M+

Trades

9M+

Volume traded

$8B+